Construction loan closing costs calculator

The borrower has elected to finance 2000 in eligible loan closing costs that does not include the upfront guarantee fee. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

Explanation Of Loan Estimate Form Youtube

Homebuyers in the US.

. What is an FHA construction loan. However the borrower is responsible for closing costs. Here is Bankrates guide to the best construction loan lenders in 2022.

For a 200000 loan a discount point would cost 2000 upfront. There isnt a one-size-fits-all construction loan. These are fees for things like mortgage origination and transfer taxes.

Its higher than the buyers closing costs because the seller typically pays both the listing and buyers agents commission around 6 of the sale in total. VA loan closing costs average around 1 to 3 percent of the loan amount on bigger home purchase prices and 3 to 5 percent of the loan amount for less expensive homes. Of the property is 98000.

Closing costs for sellers can reach 8 to 10 of the sale price of the home. Closing costs on a VA loan. This same calculator is used to calculate the loan amount.

The MIP displayed are based upon FHA guidelines. A down payment is not required on VA loans. Lets dig into the key differences in each category.

Owner-Builder Loan This type of loan has the same structure as a construction-only loan but an owner-builder loan does not have a contractor who works on the project and receives the money. For today September 13th 2022 the current average mortgage rate for a 30-year fixed-rate mortgage is 5668 the average rate for a 15-year fixed-rate mortgage is 4967 the average rate for a. Calculate the total loan amount including the entire upfront.

The other financing option is a two-time-close construction loan two separate loans. VA Loan-Related Closing Costs. And they can be quite expensive.

When you purchase a home you are going to have to pay closing costs. 75k or higher which varies by lender. However the borrower would recoup the upfront cost over time thanks to the.

Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. Begin with the base loan amount of 100000 98000 purchase price plus 2000 eligible closing costs. For today Thursday September 15 2022 the national average 30-year VA mortgage APR is 5650 up compared to last weeks of 5480.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. The construction-to-permanent loan and the FHA 203k loan. The flat rate loan calculator exactly as you see it above is 100 free for you to use.

Calculator Rates Construction Loan Calculator. Its important to remember construction costs and property values vary a lot by state. Other loan programs are available.

Loan costs and other non-loan costs. Fees and taxes for the seller are an additional 2 to 4 of the sale. The figures displayed above are based upon your input and may not reflect your actual mortgage payment or total monthly costs.

Loan-related costs are tied directly to your home financing and can vary quite a bit from lender to lender. Pay on average 5749 for closing costs including taxes according to a 2019 survey from ClosingCorp a real estate closing cost data firm. In fact you can.

A discount point costs 1 of the home loan amount. FHA requires a 35 down payment as well as an upfront and monthly mortgage insurance in many cases. Youve probably read that closing costs on a home loan are usually 2 to 5 of the amount borrowed.

Construction to Permanent Loan Calculator. Checklist of cost-of-home ownership expenses. Of course these are estimates the actual amount you will need could be higher or lower depending on factors like where you live the type of home youre buying or if its a new construction.

The clear benefit it has over the other is the single set of closing costs to get the full loan amount and an ability to fix the interest rate earlier. Theres only one closing so youll just have to pay closing costs once. So on a home that costs 200000 your closing costs could run anywhere from 6000 to 8000.

Mortgage loan basics Basic concepts and legal regulation. Construction loan costs vary depending on the size of the loan the property location the type of loan the type of lender and the borrowers qualifications. Almost every lender will use a slightly different version of this calculator to determine the loan amount for a construction loan.

After the projects completion the loan converts to a permanent 15 or 30-year fixed or adjustable mortgage loan. This type of loan allows the borrowers to avoid paying for closing costs twice which may save up to 6 of the construction cost. There are two types of FHA construction loans.

Todays national VA mortgage rate trends. Estimate Construction Loan Payments to Build a New House or Improve Your Home. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan.

Best Homeowners Insurance for New Construction. This time factor in estimated closing costs which can total anywhere from 2 to 5 of the purchase price commuting costs and any immediate repairs and mandatory appliances that you may need. However common construction loan requirements include.

Typically called a construction-to-perm loan this is an. A mortgage in itself is not a debt it is the lenders security for a debt. VA home loan closing costs and fees.

If your down payment is between 10 and 24 they can cover up to 6. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. What you ultimately owe at closing and your overall costs can be broken down into two categories.

For down payments of less than 10 the seller can assist with closing costs up to a total of 3 of the loan amount. All in all a construction-to-permanent loan is the more streamlined option but not all lenders will offer this to all. An FHA construction loan is a mortgage that allows you to roll in the costs of building a home from the ground up.

VA loan closing costs range between 1 and 5 of.

How Much Are Closing Costs In Louisiana Bayou Mortgage

Home Construction Loan Calculator Casaplorer

New Development Closing Cost Calculator For Nyc Interactive Hauseit

Construction Loans What They Are And How They Work Credible

Construction Loan Calculator Construction Loan Payment Calculator

Ultimate Construction Loan Calculator Irregular Borrows

Ultimate Construction Loan Calculator Irregular Borrows

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

How To Calculate Closing Costs On A Nc Home Real Estate

Understanding The Construction Draw Schedule Propertymetrics

New Development Closing Cost Calculator For Nyc Interactive Hauseit

What Is A Loan Estimate How To Read And What To Look For

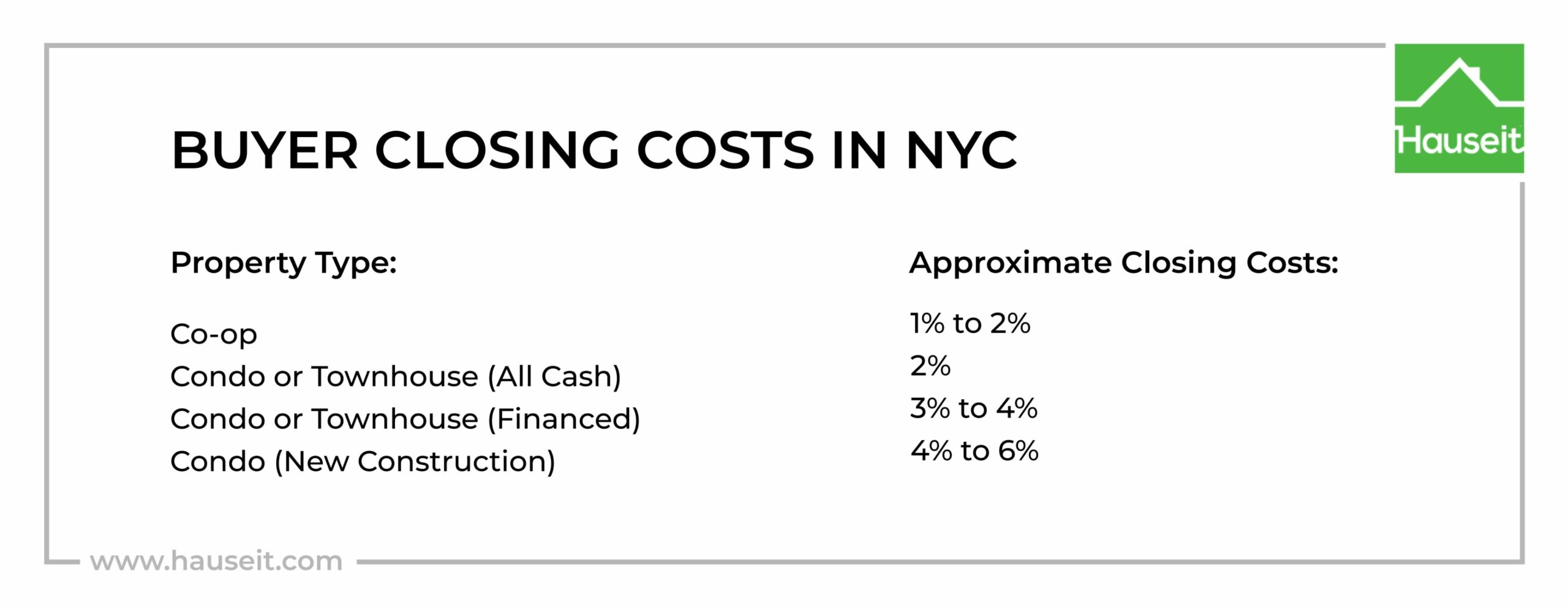

Nyc Buyer Closing Cost Calculator Interactive Hauseit

Ultimate Construction Loan Calculator Irregular Borrows

New Development Closing Cost Calculator For Nyc Interactive Hauseit

Estimating Your Home Buyer Closing Costs In Fort Hood Tx

Nyc Buyer Closing Cost Calculator Interactive Hauseit